Positive Shift in Creditworthiness

In a significant development for the Sultanate of Oman, Standard & Poor’s (S&P) has upgraded the country’s credit rating to BBB, coupled with a stable outlook. This marks a pivotal moment for Oman, as it signifies the restoration of its investment grade after nearly seven years.

Attracting Investors and Enhancing Access to Capital

The upgrade to a BBB rating indicates a positive shift in Oman’s creditworthiness, making it more attractive to investors and enhancing its ability to access international capital markets. This decision comes as Oman continues to implement reforms aimed at diversifying its economy away from oil dependency.

Building Confidence Through Economic Reforms

Analysts believe that the stable outlook further underscores S&P’s confidence in the government’s ongoing efforts to strengthen economic resilience. Measures to improve public finances, enhance revenue generation, and stimulate private sector growth are pivotal to this transformation.

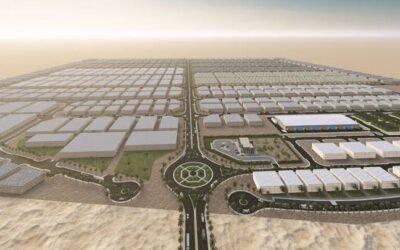

Fostering Foreign Direct Investment

The upgrade is expected to foster greater investor confidence and could lead to increased foreign direct investment, which is crucial for the Sultanate’s long-term economic growth. It reflects broader regional trends, where Gulf Cooperation Council (GCC) countries are increasingly focusing on sustainable economic practices.

A Motivating Factor for Continued Reforms

As Oman navigates its path towards recovery, the S&P rating upgrade serves as a reminder of the potential for positive change and development within the country. Stakeholders and policymakers will likely view this as a motivating factor to continue pursuing economic reforms and investments that promote stability and growth.

Looking Ahead: A Hopeful Future

In conclusion, Standard & Poor’s upgrade of Oman’s credit rating to BBB is not just a recognition of past efforts but a hopeful signal for the future. The Sultanate’s commitment to economic diversification and fiscal responsibility may lead to further improvements in its financial standing, making it a noteworthy player in the regional and global economies.